Industry Mise en Place: Video Game Developers

Introduction

This post will be a slightly different format than prior ones. Instead of doing a deeper look at one company we will be doing a short form overview and analysis of multiple companies (eight to be exact) in a specific industry. The Fond Investor version of an industry primer but with a bit more flavor — what we call an “industry mise en place”.

In the culinary world the mise en place is the prep done by line cooks ahead of service. Veggies are cut, sauces reduced, seasoning readied, and everything organized before the actual cooking begins. That is what we are doing here but for a specific industry that I find particularly interesting and want to learn more about. I thought it may be informative to share my notes and thoughts from the work done cutting the veggies and stirring sauces.

“Mise en place is the religion of all good line cooks. Do not fuck with a line cook’s ‘meez’” —Anthony Bourdain, Kitchen Confidential

Quick disclaimer. Being that we will highlight multiple companies these are clearly not deep dives and there is still more work to be done on my end to build conviction for a potential investment. The goal is to filter the industry down to what I find to be the most interesting companies and situations.

Some of these may resonate with different readers depending on their own objectives and investing philosophy. I am giving you the ingredients and recipe, up to you if you want to make something with it. If one (or multiple) of the opportunities resonate with myself, then it may be featured exclusively in a future post, but if I can't get there in terms of conviction I feel no obligation to write any name up just because some work has been put in. I had a lot of fun putting this together so hopefully it is informative and enjoyable to read. With all that addressed — let's get our knives out.

Why Game Developers?

The first industry mise en place will cover game developers, with a focus on smaller under the radar developers primarily located in Western Countries (rationale for this discussed later). I wanted to learn more about this niche market and profile potential investments for a number of reasons, outlined below.

Large and Growing Market. Lots of people game. The game industry is estimated at USD $217 billion in 2022 and is expected to grow at an annual growth rate of 13.4% from 2023 to 2030. Furthermore, spending on video games tends to be non-cyclical and relatively recession resistant (not quite as true for mobile game spending). This is a growing market worth having exposure to.

Compelling Investment Potential. The scalability for game developers can be quite large. A majority of costs are during development, with little marginal costs to distribute the game once it's complete. This means there is meaningful value creation potential for smaller studios if they can develop quality intellectual property (“IP”) and release a few relatively big hits. From there it can be a bit of a flywheel effect. The developer gains a devout following for future launches and the developer can invest excess cash into more programmers, technology, and marketing to make bigger and better games. The economics of this business makes identifying successful developers an attractive investment proposition.

Shifts in Industry Dynamics. The industry of game making has reached an interesting inflection point. There seems to be an increasing bifurcation between large studios, often referred to as “AAA developers”, and smaller developers. Gamers seem increasingly frustrated by the product put out by AAA developers which can feel stale, uninspired, and rushed (Redfall is a great example of this). Meanwhile, smaller studios are creating games with more passion that gamers actually want to play (Larian Studio’s success with Baldur's Gate 3 serving as a juxtaposition to Redfall). More so than ever smaller developers appear well positioned to compete with AAA developers when you couple more creative freedom with greater efficiencies driven by technology, such as the game engine Unreal Engine 5.

Personal Interest. I do have interests outside of finance and food and one of them is video games. As a lifelong gamer I am familiar with a number of the IPs discussed below having played many of the titles myself. I like a pretty diverse range of games (I'm not just exclusively crushing noobs on CoD) and have played across a number of consoles and platforms. I mention all this because I do think it gives me some advantage in understanding what the gaming community is looking for in games/developers, and what unreleased titles have the most potential in terms of sales.

What I Look for in Game Developers

Below are what I consider the most important factors when reviewing game developers. The first is by far the most important in my eyes.

Passionate About Making Great Games. This first one should go without saying but due to corporate agendas or outside investor pressure even high quality studios will release incomplete or uninspired games. Game development is ultimately a creative pursuit, and creativity requires passion to be at its best. You can truly tell the difference when a game is made by people that put their heart and soul into development. Furthermore, this type of environment tends to attract some of the best and most motivated talent. Games made with passion tend not to be cookie cutter, are more unique, more immersive, full of emotion, and just more fun to play.

Strong Intellectual Property. Content is king. One of the most valuable assets for a game developer is strong IP. “Strong” does not have to mean a franchise as recognizable as Call of Duty, but one where sequels will likely do as well or if not better in terms of sales thanks to a growing following. A portfolio of proven IP provides a developer more certainty and consistency in the future monetization of projects. Even just one decent IP can be very impactful for smaller studios as it helps eliminate the dynamic of having to depend on every new release to keep the doors open. Strong IP also makes a studio a prime acquisition target, which there have been a plethora of recently, for a larger studio or the likes of Microsoft or Sony.

Robust and Promising Pipeline. This one does not need too much explaining. It is good to see a mix of proven IP and new IP in a developers pipeline. Most importantly, the games should look promising and show signs of clear progress from prior releases. Ideally there is not too much of a “dead period” between the release of titles.

Focused on Developing Internal IP. A common practice for developers is to partner or take the lead on the development of other studios IP. I am fine with seeing some of this but when I look at a developer’s pipeline I want the majority of titles I am excited about to be their own IP. This is because developers have more control over their own IP, will make more selling it because they are not partnered with anyone, and as discussed earlier a robust IP portfolio gives developers more longevity.

Ideally Can Self Publish. Ideally a developer can self publish as this allows them to control all phases of development and sales of the game (game publishing is essentially the term for taking a game to market). External publishers can take anywhere from 30% to 50% of sales but are a necessary evil for some smaller studios that don't have the scale to ensure the game is reaching the broadest possible audience. One other note is many developers with publishing capabilities will publish for other smaller studios. I am ok seeing this as long as publishing is not the primary revenue driver for the studio because a business has less control over their own destiny if the majority of the business is publishing other’s games.

Smart Development Strategy. This being last on the list should not be interrupted for a lack of importance. Being where a majority of costs are concentrated, development is where most developers get themselves in trouble. Developers have to run a cost efficient development phase but also balance this with the quality of the end product, time in development, and ensure not to overwork employees (known as “grind” in the industry). This can be a difficult balance to strike, and varies from developer to developer, but it is crucial because disregarding any of these factors could result in a development, and the developer, falling flat.

List Creation Methodology

Running screens to identify companies produces mixed results, and this is especially true for game developers due to the release cycle of games making historical financials almost meaningless in some cases. With that said there are A LOT of game developers globally and the universe had to be whittled down somehow. I tried to cast the widest net, and to do this I used Stratosphere’s global screener to produce a list of all publicly traded video game companies. From there I excluded any companies based out of Asian countries (notably Japan, China, and S. Korea) because I am not as familiar with this IP and quite frankly I just plain don't get some of the games due to cultural barriers and/or me being a dense American.

Next, I filtered by market cap between $50 million and $5 billion USD. This helps get rid of the very small developers that likely would not make the cut and it also removes the mostly U.S. based giants in the industry such as EA, ATVI, TTWO, and others. Not to say these are bad companies, but they are less interesting because these are known commodities that are well covered by analysts and they have less upside optionality than smaller developers.

What I had left was a list of 70 odd companies. From this list I manually reviewed each company and removed companies that focused on mobile/browser based games and companies that primarily develop casino games. A final dash of discretion was used to reduce the list down to what I considered the eight most interesting game developers (based on the six criteria outlined in the last section).

CD Projekt SA (CDR)

Country: Poland

Market Cap: $3.8 billion

Insider Ownership: 34%

Company Background & Profile: The largest developer on the list in terms of market cap, CD Projekt (“CDR”), serves as a good example of how smaller studios on this list can rapidly scale by leveraging a strong IP and growing with the release of increasingly higher quality content. This is what CD Projekt did with The Witcher series: starting with The Witcher in 2007, the Witcher 2 in 2011, and the Witcher 3 in 2015 (widely regarded as the game of the year in 2015). The Witcher 3 catapulted CD Projekt into the international big leagues and would sell over 50 million copies (which currently ranks 9th on the list of all time best selling video games).

After the wild success the company had with the Witcher 3, CD Projekt switched gears to release their next IP in the highly anticipated Cyberpunk 2077 in December of 2020. Unfortunately, the release of Cyberpunk was in technical terms “a hot mess”. The game was loaded with game-breaking bugs, was nearly unplayable on the console additions due to performance issues, and simply did not seem to be anywhere near ready for release (the game was in such rough shape that Sony removed it from the PSN Store). The game sold 13.7 million copies in the first three weeks after launch but in the nearly three years since has only sold an additional 6.3 million copies, totaling over 20 million copies (a disappointment considering the potential the game had).

The tumultuous launch of Cyberpunk tarnished the game’s and developer’s image in the eyes of many gamers, which will take a series of strong releases to restore. It does appear that steps have already been taken to avoid another misstep like Cyberpunk. First off a major update to the game will be released for all players in September (discussed more later). Perhaps more importantly, CDR clearly acknowledges the failure of Cyberpunk and the messaging from the company indicates they are more focused on their audience. Lastly, CDR is moving away from their internal “Red Engine” in favor of Unreal Engine 5 after the release of the Cyberpunk expansion. Red Engine was being pushed to its limits and needed some serious updates — which was clearly reflected in Cyberpunk. This should help with the stability of future launches and get new team members up to speed quicker as they will be using a more universal engine in Unreal Engine 5.

IP and Game Quality: CD Projekt only has two core IP’s, The Witcher and Cyberpunk. Both these IPs leverage pre-existing IP with the Witcher based on the fantasy novels by Polish author Andrzej Sapkowski and Cyberpunk based on a comic book series. Working on an IP that already has a fanbase and rich history/lore has served CD Projekt well. These are very strong IP’s with both being popular enough to have their own Netflix shows. Before the Cyberpunk debacle the studio had a reputation for developing high quality games, with the Witcher 3 being one of my personal all time favorite games.

Pipeline: The studio has spent the last few years trying to right the wrong that was Cyberpunk with a series of updates and bug fixes and plans on releasing Phantom Liberty, the first paid DLC for the game, in September. Alongside the release of Phantom Liberty, Cyberpunk 2077 is also getting the sizable Update 1.7, adding new features and retooling parts of the game that have needed work since launch. This means players who are not planning on buying the expansion will still receive comprehensive changes to the core mechanics and experience. After the update, Cyberpunk should be a much different and objectively better game than the 2020 release. This could drive some new demand, especially from customers on the new generation consoles, but more importantly this could be the first step in restoring the studios image. With the upcoming Cyberpunk content release on the horizon CD Projekt will soon begin to shift resources to developing a new game in the Witcher universe codenamed “Polaris” and developing a third entirely distinct IP called “Project Hadar”.

Development Teams Engaged in Ongoing Projects:

Initial Thoughts: CD Projekt makes incredible games. Cyberpunk appears to be a misstep caused by the studio feeling the pressures of a public company. I believe this was an important lesson for the young studio and that the company has emerged with a new focus to deliver quality games. CD Projekt has the IP and game quality to sell over 30 million games with every major release on the strength of the Witcher franchise, a rejuvenated and fresh perspective on the Cyberpunk franchise, and a third IP in the works. That cannot be said for many other developers on this list.

Embracer (EMBRACB)

Country: Sweden

Market Cap (USD): $2.9 billion

Insider Ownership: 38%

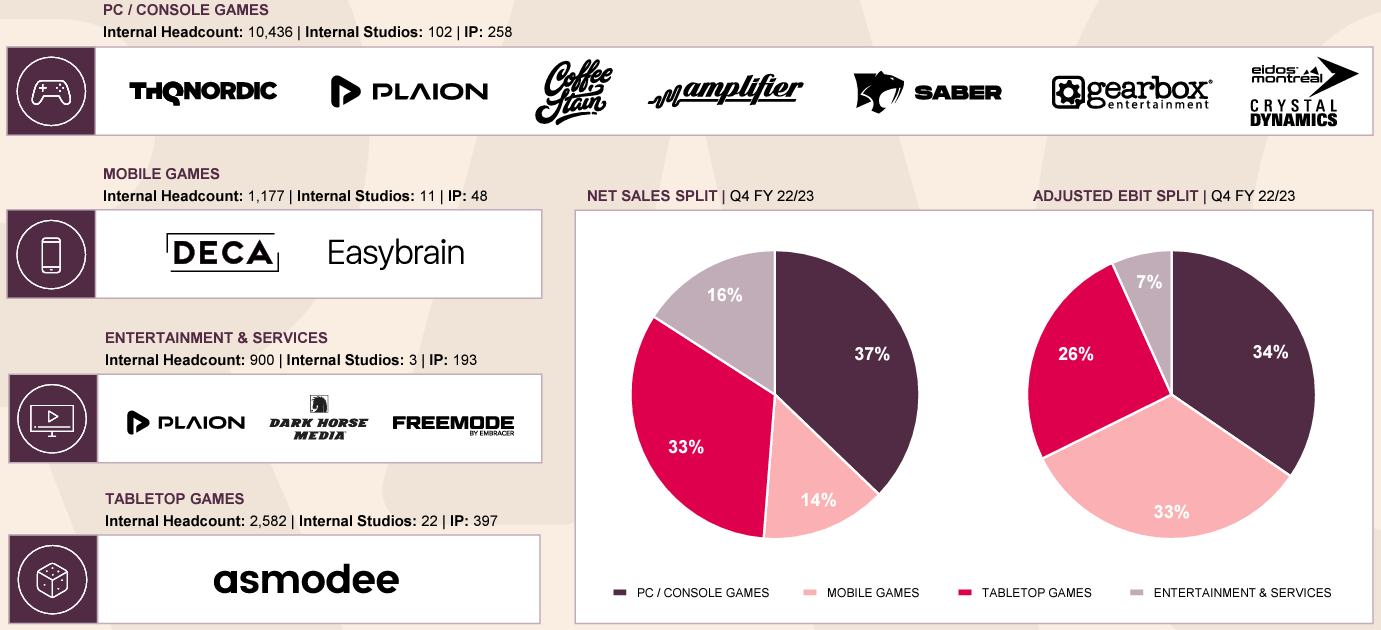

Company Background & Profile: Embracer is a large media holding company that owns a number of game studios as well as other media assets such as tabletop games and comic books (the breakdown of each segment is shown below). The abridged Embracer story is the company went public in 2016 under the name THQ Nordic and would then go on an absolute spending spree acquiring over $10 billion in studios and other assets. This included paying €3 billion for tabletop game company Asmodee (which was 12x a Covid inflated EBITDA of €250 million).

This focus on growth at all costs would catch up to Embracer with investors spending the last two years questioning when/if value would be created. This all came to a head in May of this year when a then undisclosed partner dropped out of a $2 billion development deal (now allegedly reported to be Saudi funded Savvy Games Group). This resulted in a major adjustment to guidance (from $1.1 billion to $740 million in annual EBIT) and further depressed the share price, leaving the stock down ~80% from all time highs in May of 2021.

The loss of the expected $2 billion in revenue forced Embracer into cost savings mode by delaying projects, closing studios, and laying off staff. Due to the magnitude of recent M&A Embracer is bloated by large personnel expenses from employee earnouts used to incentivize staff of newly acquired studios from leaving. The studio must now successfully focus on running a more cost efficient organization and monetizing a vast IP library.

IP and Game Quality: Embracer has tons of IP (owns or controls over 850 IPs across 138 studios to be exact). The core IP acquisition strategy consists of acquiring established but currently underperforming franchises and reinvigorating them. The quality of the IP is good but a bulk of it certainly reflects this strategy with some of the more notable IP being aged franchises such as Borderlands, Saint Row, and recently released Dead Island 2. With that said there are some smaller developers within Embracer that are hidden gems with interesting games in the works. There is too much IP to be covered here but some highlights of the IP across the 12 operating groups are provided below.

PC/Console Games:

THQ Nordic (22 internal studios, founding group): Notable IP includes Destroy All Humans, Darksiders, Elex, BioMutant, Quantum Break, and the recently released and well received Remnant 2. I am personally looking forward to the Gothic remake.

Plaion (13 total internal studios, acquired in 2018): Focus more on the publishing and licensing of IP than the other groups. Notable IP and projects include Dead Island, Metro, Saints Row, and Kingdom Come: Deliverance (the last being a lesser known title from Czech developer Warhorse Studios that I am a fan of).

Coffee Stain (8 internal studios, acquired in 2018): Coffee Stain Group is focused on developing indie games. This group created IP such as Goat Simulator and published Valheim - both of which were major successes.

Amplifier (17 internal studios, acquired in 2019): This group focuses on investing in new IP development and I am personally not familiar with any of the IP in this group as it is mostly new. Key IP listed on the website include Dice Legacy, Lightyear Frontier, and First Class Trouble.

Saber (30 internal studios, acquired in 2020): IP in this segment includes what I find to be less exciting franchises such as Space Marine and Snowrunner.

Gearbox (7 internal studios, acquired in 2021): Gearbox has an impressive development track record working on the original Halo, Counter-Strike, Brothers in Arms, and Borderlands. True pioneers in the industry but little in the way of new/fresh AAA quality IP.

Crystal Dynamics and Eidos (5 internal studios, acquired in 2022): Crystal Dynamics and Eidos-Montréal’s portfolios feature popular and critically acclaimed original IPs like Tomb Raider, Deus Ex, Legacy of Kain, and Thief.

Mobile Games:

Deca (9 internal studios, acquired in 2020): Mobile publishers and developers with an expertise in live operations of Free-to-Play games. No idea on these games, IP includes franchises such as Party in My Dorm and Super Stylist.

Easybrain (2 internal studios, acquired in 2021): Developer of best-selling puzzle games such as Art Puzzle, Solitaire, and a number of variations of Sudoku.

Tabletop Games:

Asmodee (22 internal studios, acquired in 2022): Probably the largest and highest quality board game IP catalog out there with Catan, Ticket to Ride, Dobble/ Spot it!, Exploding Kittens and 300 more across a variety of digital and physical platforms.

Entertainment and Services:

Plaion (13 total internal studios, acquired in 2018): Repeat of the second group listed in pc/console games. Plaion also includes PLAION PICTURES – one of the leading independent film and home entertainment distributors in Europe.

Dark Horse Media (3 divisions, acquired in 2022): Dark Horse is a publisher of comics, graphic novels, collectibles, and art books. Publications include company owned titles, such as The Mask, Time Cop, Father’s Day, and Ghost and licensed titles, such as Star Wars, Avatar the Last Airbender, Stranger Things and The Witcher, as well as creator-owned titles, such as Hellboy, The Umbrella Academy, Mind MGMT, and more.

Freemode (3 internal studios, founded in 2022): Owns IP rights to video games based on Lord of the Rings and the Hobbit intellectual properties. This is as good as IP gets but the content will need to be high quality. Case and point is the recent flop of The Lord of the Rings Golumn.

Pipeline: Too much to give a thorough review of. The announced pc/console games in development are provided below with the most interesting looking games starred. You will notice that the out of the five upcoming game I found to be the most interesting only two are internally owned IP.

Initial Thoughts: One has to first be okay with the mix of non game developer assets such as Asmodee. Even though I think Embracer overpaid for Asmodee it is a good business with an impressive table top IP catalog. The big hurdle for me on this one is the fact that Embracer has destroyed value up to this point, spending $12 billion on M&A and game development while currently boasting a $2.9 billion market cap. However, Embracer owns tons of IP that seems wildly under-valued if properly monetized. This name has more hair on it than the others on the list, but these types of situations can lead to significant value.

Paradox Interactive AB (PDX)

Country: Sweden

Market Cap (USD): $2.6 billion

Insider Ownership: 3%

Company Background & Profile: Paradox Interactive is the premier developer and publisher of strategy and management games. If you want to conquer all of Europe in an epic medieval campaign: Paradox has the game for you. If you want to be a galactic overlord that conquers a whole galaxy: Paradox has the game for you. If you want to design and manage your own city that runs entirely on renewable energy: Paradox has the game for you. If you want to… well, you get the point. As stated on Paradox’s website, “what universe do you want to discover?”. Paradox has developed a series of strategy and management games that have a devout fanbase. I have personally nerded out playing two of their games (Stellaris and Crusader Kings) and can attest to how addictive it is to see your great plans of domination unfold after multiple decades of planning (decades of in-game time, still tens of hours in real life).

IP and Game Quality: The game portfolio consists of popular franchises such as Stellaris, Europa Universalis, Hearts of Iron, Crusader Kings, Cities: Skylines, Prison Architect, the Surviving games, Age of Wonders and Victoria. Paradox Interactive also owns the World of Darkness brand catalog. These are not the biggest IP’s but they are quality. The games themselves are a little difficult to approach for your average gamer but very fun if you take the time to learn how to play them.

Pipeline: Paradox’s pipeline is not as lumpy as others on the list. It is more of a constant flow of new games from the 20 different IPs in the portfolio, DLC, and new IP. Upcoming games that have been announced are shown below. Cities Skylines II likely has the most potential, coming in at number seven on Steam’s top wish listed games.

Initial Thoughts: Paradox knows their niche and dominates. Shares seem reasonably valued after a 50% gain this year but I view this company as one of the higher quality and more dependable on the list thanks to a strong portfolio of games. For quality investors this is likely the most attractive on the list, but the price point could be better.

11 Bit Studios (11B)

Country: Poland

Market Cap (USD): $407 million

Insider Ownership: 17%

Company Background & Profile: 11 bit is a Polish based developer founded by former members of CD Projekt Red and Metropolis Software. A quote directly from their website encapsulates how I view them as developers.

“we choose to make universes filled with stories that provoke thought, ask ambiguous questions, and that explore the unknown. We hope these stories will stay with you long after seeing the end credits.”

The company released well received games in 2014 (This War of Mine) and 2018 (Frostpunk) that have enabled the studio to invest and scale to where they are today, on the brink of releasing multiple titles on a more frequent cadence.

IP and Game Quality: Notable IP include Frostpunk, This War of Mine, and serving as the publisher for Moonlighter. All these games are 8/10 or higher in terms of user and media reviews. The aspects of 11 bit’s games not captured by reviews or number of copies sold is the amount of emotion and original worldbuilding that goes into each title. This War of Mine, for example, is a survival game that differs from most war-themed video games by focusing on the civilian experience of war rather than front line combat. This could just be a novel idea with lackluster gameplay. Not in the hands of 11 bit. My impression of This War of Mine from playing it a number of years ago is that it is a beautifully designed game that is packed with emotion. TIME magazine described 11 bit as the creator of games with “unflinching elegance and a grimly poetic pulse”. This studio clearly prioritizes our number one criteria of making games with passion.

Pipeline: 11 bit has an exciting slate of releases headlined by internal IP Frostpunk 2 (H1 2024), The Alters (H1 2024) and an unannounced 3rd party title in late stage development named “Project N” (beginning of 2024). 11 bit is also serving as the publisher (and owns ownership interest in the developers) for The Invincible (Q4 2023) and The Thaumaturge (Q4 2024). I recommend watching the linked launch trailers for these ones. I won't go into details on each game but a common theme across these titles is they are unique games with plots, gameplay, and worlds you definitely haven't seen before. The most notable title in the pipeline is Frost Punk 2. The first Frost Punk sold over 3 million copies and early reports are that Frost Punk 2 is an even better game with some fresh new gameplay mechanics. Furthermore, the game is the the #8 most wishlisted title on Steam, with all the games ahead of it being released in 2023. This should be a big title for the studio (~5 million copies type potential) with the other three new IPs being a little harder to predict but all have meaningful upside potential.

Initial Thoughts: I think 11 bit is a high quality studio that makes great games. After a few years of a barren release schedule the slate of upcoming games makes this feel like a key point in the company's growth trajectory. It is difficult to estimate how many copies a game will sell but it feels like the five aforementioned titles have the potential to do around 10 million copies over the next few years and really put the studio on the map. That would be over $200 million in cash flow using a rough estimate that each copy flows through at ~$20 in cash. With a market cap of ~$400 million the potential value here seems underappreciated. I think the last slide of the 2023 investor conference in June sums up the timeliness of the opportunity well.

Remedy Entertainment (REMEDY)

Country: Finland

Market Cap (USD): $357 million

Insider Ownership: 35%

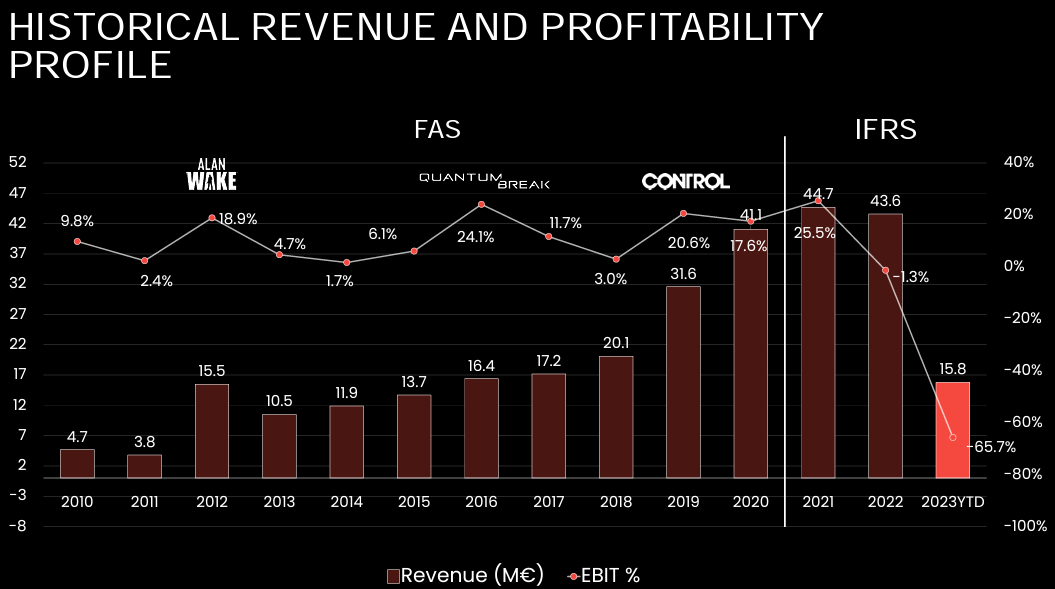

Company Background & Profile: Remedy Entertainment is known for its story-driven, stunning, and thought-provoking titles. The unique storytelling and art direction I can only best describe as very Lynchian. The developer's first major titles were Max Payne in 2008 and Alan Wake in 2012, the latter of which was a cult favorite on the Xbox 360 and sold over three million copies. Remedy would not release another major title until Quantum break in 2016, which was a quality game but did not have tremendous commercial success. Remedy went public in 2017 to increase their capability to develop more games on quicker timelines. The most recent major release from Remedy (the first while being a public company) was Control in 2019, which was successful in selling over 3 million copies but still short of the first “big hit” for Remedy.

As shown in the visual above financial performance has been lagging due to a lack of recent releases. The notable delay between releases for Remedy has prompted the company to shift strategy from purely self-publishing to working with publishing partners. This is usually a red flag for me but it is notable that Remedy is still working on its own internal IP and these partnerships appear to be good strategic fits (Remedy is not giving up artistic control over their games). Remedy now has a pipeline filled with more titles than ever, the main concern would be these games lose that special Remedy touch as they are co-developed.

One note on games in the pipeline staying consistent is that Remedy has used and will continue to use their proprietary engine and techstack called Northlight. This should help their new games have the same feel because Northlight certainly plays a role in the differentiated games and experiences Remedy is known for. Physics, lighting, and ray tracing are particular strengths of the engine.

IP and Game Quality: Most notable IP are Alan Wake, Control, and formerly Max Payne (Remedy was in some financial trouble before the second Max Payne came out, so they ended up selling all the rights for Max Payne to Take-Two/Rockstar in 2002). These are great IPs and are well positioned for future monetization. Alan Wake 2 had been effectively on hold until the Alan Wake publishing rights shifted from Microsoft back to Remedy in 2019, Remedy has been pretty busy with development since. Also, an Alan Wake series is currently in development at AMC which should help Alan Wake 2 get more exposure. In terms of game quality I think this review of Control does a good job of summarizing not just Control but Remedy games in general: there is a lot to like (especially in the world building), but the games have so far fallen short of being true masterpieces. This does make me optimistic for future titles if Remedy listens to feedback and keeps improving.

Pipeline: Alan Wake 2 is the big upcoming release on October 17th. The game visually looks fantastic and I think has the potential to be a fairly large success by expanding the brand’s reach to new audiences. Early feedback from showcases at different game shows has been very positive. A friend and fellow gamer I was chatting with about Alan Wake 2 described it perfectly by saying the game “looks like a video game adaption of True Detective Season 1” (which is a great thing). The other projects in the pipeline are all in “proof-of-concept” but point to a busy schedule of releases in the latter half of 2024 into 2025.

Control 2 and Project Condor: Remedy is working with 505 games (subsidiary of Digital Bros) to co-develop Control 2 as well as a multiplayer spin-off game of Control, codenamed Project Condor. Expanding this IP makes sense and the partnership with 505 allows for these games to get to market much sooner.

Project Vanguard: Vanguard is a project with Tencent with the described goal of “challenging conventions and creating a new breed of social, multiplayer”. This is part of Remedy’s strategy to develop multiplayer games with longer recurring revenue streams. Being partnered with an industry giant such as Tencent should help with marketing but this game will likely be the “least Remedy like” of future releases.

Max Payne 1 & 2 Remake: These should do pretty well for remakes. Max Payne is a shooter endeared with lots of gamers. These will be fully funded by the IP owner Rockstar.

Initial Thoughts: Remedy has shifted strategy to redefine and invest in traditional “AAA” games. This is reflected in a robust pipeline but the big question is will Remedy be able to maintain their strengths as a developer during this growth? Profitability has been depressed due to Remedy being in the “investment phase” but that will change in October with the release of Alan Wake 2, and then four more titles to come out in 2024/2025. If Remedy can stay true to what gamers love about their content during this expansion phase the future looks bright.

People Can Fly “PCF Group SA” (PCF)

Country: Poland

Market Cap (USD): $334 million

Insider Ownership: 63%

Company Background & Profile: People Can Fly's (“PCF”) first game was Painkiller (2004). Its success led to a deal with THQ for the game Come Midnight, which allowed the studio to expand. After the game was canceled, People Can Fly found itself in financial trouble. Epic Games acquired a majority share in People Can Fly in August 2007 and collaborated with the studio on projects such as Bulletstorm (2011) and Gears of War: Judgment (2013). Epic bought the studio outright in August 2012. The founder of “legacy People Can Fly” subsequently left the studio and later founded The Astronauts. People Can Fly was rebranded Epic Games Poland in November 2013. The Astronauts spun off under its former name and logo in June 2015 under the lead of chief executive officer Sebastian Wojciechowski. Its most recent game is Outriders, which was released April 2021.

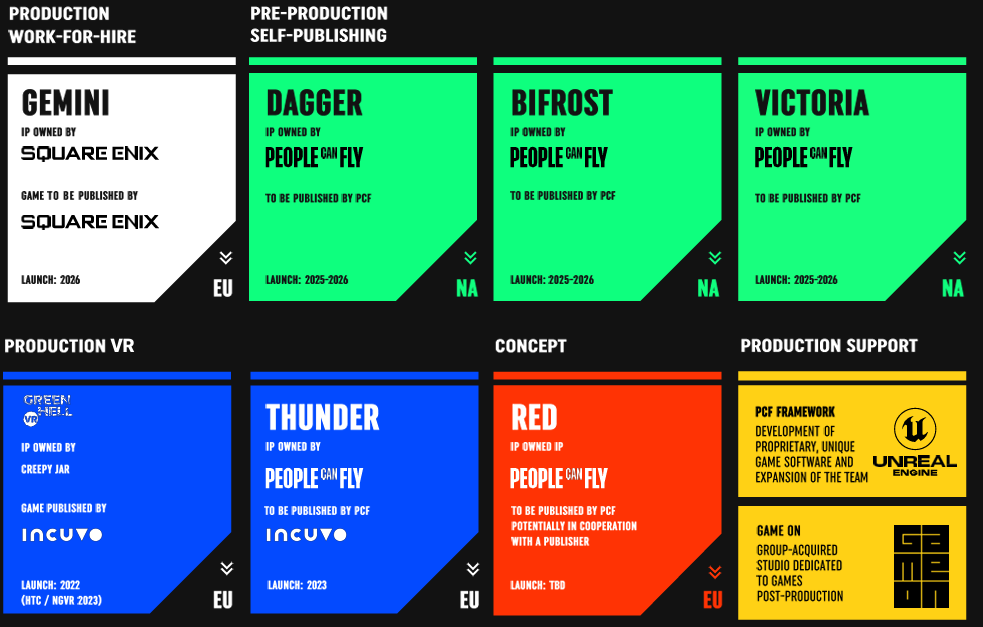

In January 2023, the Group updated its strategy – with the goal to strengthen the Group’s publishing division and release more projects in the self-publishing model (opposed to a work-for-hire model). PCF has laid out some pretty aggressive strategic goals (summarized below) with the cumulative EBITDA target of $1.5 billion PLN between 2023 and 2027 which would be greater than the company's current market cap.

IP and Game Quality: The PCF team has worked on some genre defining games such as Gears of War, Unreal Tournament, and Fortnite. The game development track record and experience at PCF are much higher quality than other similar sized developers. Unfortunately, due to the company’s work-for-hire business model, they do not have that impressive of an IP catalog themselves, with the most notable owned IP being Painkiller, Bulletstorm, and Outriders (these games sold around 2 to 3 million copies each). The studio clearly is looking to change this with the new strategy shift to build out a more recognizable IP portfolio with upcoming titles in the pipeline.

Pipeline: The pipeline appears robust but relatively little is known about the games and the launches won't really ramp up until 2025. A quick summary of the 8 projects: Gemini, a new AAA game developed in partnership with global publisher Square Enix; Maverick in collaboration with Microsoft; projects Dagger, Bifrost and Victoria to be released in the self-publishing model; one project in the concept phase – Red; as well as two projects in VR technology – Green Hell VR and Bulletstorm VR – a game based on the IP from the Group’s portfolio. The owned IP being developed and published by People can Fly (little more info on these below) won't launch until 2025-2026.

Project Dagger: AAA-segment game represents PCF’s first action RPG, with new gameplay elements and storyline structures not previously used by PCF. This project will be self-published and is intended as the first in a new game franchise, and targeted at the new generation gaming platforms.

Project Bifrost: AAA online shooter. As an internally financed and self-published live game this team will grow post launch as the game achieves its KPIs.

Project Victoria: AAA multiplayer survival game. Internally funded and published, it will follow the same model as Project Bifrost in growth post launch as the game achieves its KPIs.

Initial Thoughts: The historical focus on co-developing third party IP is not ideal but the company is changing strategy. The pipeline is promising – 8 new games in the making, including 3 new internally developed IPs. This feels like one to monitor. There is potential here given the developers track record and expertise in developing AAA first person shooters (a large market within gaming), but I would want to know more about the owned IP in the works (projects Dagger, Bifrost, and Victoria) before making any investment decisions.

Creepy Jar (CRJ)

Country: Poland

Market Cap (USD): $130 million

Insider Ownership: 34%

Company Background & Profile: Established in 2016, Creepy Jar is a collection of seasoned developers and creators combining years of experience from other successful studios such as Techland, Flying Wild Hog, and 11 bit studios. The studio released its first game in September of 2019, an open world survival game set in the Amazon rainforest, called Green Hell. The game was well received by gamers and sold over 4.5 million copies as of May 2023 (not a bad figure for a studio's first game). The Creepy Jar team truly appears focused on creating high quality content for gamers. This is reflected in regular free updates to Green Hell to improve the game for all players.

IP and Game Quality: The IP consists of the aforementioned Green Hell and the next game in development, Chimera. There is not much proven IP value here yet but Creepy Jar has started to build its reputation as a quality developer in the survival genre niche.

Pipeline: Creepy Jar is currently working on the development of their next project, named Chimera. Based on the description from the Steam posting (shown below), Creepy Jar is adding gameplay mechanics such as base building and resource management to the survival mechanics that were so successful in Green Hell.

“Explore a mysterious planet in an ever-changing open world torn by recurring cataclysms. Build a complex industrial system to extract resources, produce goods and expand your base. Fight against hordes of alien monsters to defend your base and survive, alone or with friends.”

Initial Thoughts: The studios seems focused on creating quality content and had a great first release in Green Hell. Feels like Chimera will be a similar success which would continue to build momentum for the studio. The only issue is they don't have an IP that can scale yet and a lot is riding on the release of their next title (pretty binary situation). Seems just a little too early to be able to confidentiality invest in but I do have the feeling that this studio will be much larger 5 to 10 years down the line. Maybe a good speculative bet to throw some “fun money” at for now.

Don’t Nod (ALDNE)

Country: France

Market Cap (USD): $117 million

Insider Ownership: 23%

Company Background & Profile: Don’t Nod gained a reputation for unique narrative experiences with engaging stories and characters with the Life is Strange franchise. Although well received, these and other games by Don’t Nod are categorized as “narrative adventure” games, which have a very limited market appeal. As the studio looks to continue to grow, a recent strategic decision was made to shift their focus into the development of action RPGs, which should increase the commercial appeal of their games. This sort of strategy shift would usually give me pause, but I think the qualities that stand out in their games (character development, tough decisions making) and the passion put into games by this developer should translate to differentiated and high quality RPGs.

To date Don’t Nod has released one action RPG in 2019 called Vampyr (over 2 million copies sold). Based on reviews and conversations with others that have played the game it was a frustrating game due to the fact it had so much potential but some flaws held it back. For the studios first foray into the genre I think this is promising, especially if the next action RPG released (Banishers in November) shows a notable step forward.

This one gets even more interesting with Tencent acquiring a 42% minority interest in the company back in 2021. This is a good strategic partner to have on your side but the bigger impact is this investment provided the funds to allow Don’t Nod to self-publish games.

IP and Game Quality: The IP for the game the studio is most known for, Life is Strange, is actually owned by Square Enix, Don’t Nod just did an incredible job developing it. In terms of owned IP Vampyr is probably the most notable considering it is in the RPG genre, but I am not sure if it will ever get a sequel or not. Game quality is definitely high and I think Don’t Nod is another studio that puts lots of passion into their games (and it shows).

Pipeline: Rich line-up of six intellectual property titles through 2025, including four developed in-house and two externally (Studio Tolima and Tiny Bull Studios). The two internal releases announced are JUSANT an “action-puzzle climbing game” that actually looks pretty fun to be released in October and Banishers Ghost of New Eden releasing on November 7th. Banishers will be a big release for the studio as it marks a new stage in the studio’s development into the action-RPG segment. It does not need to be a perfect game but I think there is a lot riding on it. There should be a clear step up from their first foray in the genre in 2019’s Vampyr. I am personally excited after watching the gameplay trailer and early previews have been positive as shown here and here.

Initial Thoughts: The quality of the developer and shift of strategy into action RPGs, supported by a Tencent investment, make this interesting. The enterprise value of this company is less than $100 million so only one moderately successful release is needed to justify the value. Making any sort of investment ahead of Banisher's release could be risky as I think its success (or failure) will be very telling to the developers strategy in shifting focus to RPG’s. With that said, given my thoughts on the developer, I am optimistic they will deliver with Banishers and future RPG titles.

Other Developers

Below are quick notes I had on other developers that did not make the final cut. I had to limit the final list down to a manageable number so there are some interesting names in here that are probably worth doing more research on.

Bloober Team (honorable mention): Focus on horror games having worked on notable games such as Silent Hill 2 and Layers of Fear. “The overall aim of the company is to create sophisticated, character driven titles with unique worlds, designed for the most demanding of customers”.

CI Games: Notable IP induces Lords of the Fallen and Sniper Ghost Warrior. Not a personal fan of these franchises and the games receive mostly average reviews.

Devolver Digital (honorable mention): Tons of indie games such as Trek to Yomi, The Talos Principle, and Humans Fall Flat. Looks really cheap. Interesting portfolio but a lot to digest.

Digital Bros: Does not look like developing their own IP is a focus. Partner/publisher for a lot of titles including Control 2, Death Stranding, PayDay 2.

Enad Global 7: Do a lot in licensing. Upcoming owned IP not very exciting I.G.I. Origins, ‘83, EvilvEvil, Minimal Affect, Block’n’Load 2. Forward multiples are very cheap according to Stratosphere.

Focus Entertainment: Publishing/published some pretty interesting games (Banishers, Plague Tale, Atomic Heart) but internal development of IP not all that exciting.

Forever Entertainment: One of the top three largest publishers in the world in terms of the number of games released for the Nintendo Switch console (which I think is interesting). The Company also operates as a partner of numerous indie developers and develops internal IP (nothing notable at first glance).

Frontier Developments: Looks cheap after recent sell-off caused by flop of F1 Manager which was supposed to be a consistent annually recurring revenue stream. IP and pipeline just wasn't quite strong enough for me to be interested. Working on a Warhammer game, do a number of amusement park management themed games (Zoo Tycoon, Planet Coaster, Jurassic World).

Maximum Entertainment (honorable mention): Majority of revenue is not its own IP. I am optimistic (as a gamer, not investor) that the release of American Football game, Maximum Football, will be a success and provide some much needed competition to the Madden franchise.

One More Level: Upcoming title Ghost Runner 2 looks entertaining but prior titles/IP not all that impressive.

StarBreeze Studios (honorable mention): Recently acquired PayDay 3 rights which is being co-developed with PLAION. Game will be released September 21st. This is a good IP (currently number six on Steam top wishlists), but a lot riding on its success.

Team17 (honorable mention): Another one with a giant portfolio of indie games. Biggest successes appear to be Worms and Overcooked franchises. Financials look pretty good at first glance.

Thunderful Group: A lot of IP but not super familiar with any of it. Upcoming games did not look all that interesting (Steamworld Build was the featured upcoming release).

Tiny Build (honorable mention): Think this one is extremely interesting but it is very illiquid. Additionally, the name is well covered here, which I recommend checking out.

Ubisoft: May be showing personal bias here but feel like Ubisoft is a great example of how the quality of once great games can be diminished to meet the demands of a developer too focused on short term financial results and not the gamers.

Conclusion

If you made it all the way to the end congratulations, we covered quite a bit in this first industry mise en place. Due to the length of this post I will keep the conclusion short. After this initial review the three developers that resonate with me the most are 11 bit, Remedy, and Don’t Nod. These three all make impassioned games and have the most upside potential in the pipeline that I don’t believe is being fully priced in by the market. With that said I will likely begin monitoring and further researching a number of the names covered on this list.

Taking a page out of the best game developer I do want to hear feedback from readers if this style of post is informative/entertaining or should I just stay in my lane with single name write ups? Please let me know in the poll below.

Disclaimer

This publication should not be construed as investment advice. All assertions are solely the opinion of the author. The author may hold positions in the securities discussed or advise others that hold positions in the securities discussed. This publication is worked on during free-time, which reduces the amount of time and depth that can be spent on research and due diligence. Do your own research.

Great write up and as a fellow gamer this post was especially interesting for me. I hadn't previously considered the investment value of many of these studios but is now something I'll more seriously be thinking about.

This was very interesting and useful. Curious to see your thoughts now, after some time has passed and many of those stocks are down. Do you see some opportunities in the current environment?