Investment Summary:

Winmark Corporation (“Winmark” or “WINA”) is the little known company that owns the franchise rights for a portfolio of leading U.S. resale clothing and used-goods concepts. Most of our North American based readers will likely recognize their larger concepts such as Play it Again Sports, Plato’s Closet, and Once Upon a Child. We believe long-term investors should give Winmark a close look due to a uniquely resilient business model, the company being a perpetual cash flow generator/grower (which is used to return capital to shareholders), stable long-term growth drivers, and management that embodies what we consider to be exceptional stewards of shareholder capital. We wanted Winmark to be featured in our first post because we believe Winmark epitomizes the type of “fond investments” we look for here at The Fond Investor - so let's get into it.

Business Background & Summary:

Winmark was founded in 1988 as Play It Again Sports Franchise Corporation by Ron Olson and Jeffrey Dahlberg after they purchased the Play It Again Sports franchise rights. They renamed the company to Grow Biz International Inc. and would go on to purchase the rights of other resale franchise concepts leading up to the company going public in August 1993. The company struggled until Dahlberg was replaced as CEO by John Morgan, who renamed the company to Winmark in 2001. Morgan rescued Winmark from the verge of bankruptcy by revamping the strategy, shutting down struggling stores, and prioritizing the better performing franchise owned stores over corporate stores. Morgan stepped down as CEO in 2016 and was replaced by current CEO Brett Heffes. Currently Winmark owns the rights to the following five concepts:

Plato’s Closet (43% of total royalty/franchise fees): Buys and resells gently worn clothing and accessories. The target audience is females in the 12 to 25 year-old age group.

Once Upon a Child (31% of total royalty/franchise fees): Buys and resells gently used children's clothes, shoes, toys, and baby gear.

Play it Again Sports (20% of total royalty/franchise fees): Buys and resells gently used sport and fitness products. Slight mix of new goods as well.

Style Encore (4% of total royalty/franchise fees): Buys and resells more fashioned forward clothing for women. This is the newest concept, having been launched in 2013. Adjacent to the Plato’s Closet franchise but targeting an older age group.

Music Go Round (2% of total royalty/franchise fees): Buys and resells musical equipment and gear.

From these five concepts Winmark collects weekly royalties of 4% to 5% of gross sales, as well as some additional income from franchise fees. There are around 1,300 stores located in the U.S. and Canada that operate under a Winmark brand.

Across the five concepts the fundamental business mechanics are very simple. Customers come to the stores to sell their gently used goods and receive cash on the spot for the goods. These goods will then be resold at a mark-up to the purchase price (which is generally still much cheaper than buying the item new). For example, Plato’s Closet sells clothes for about 60% to 70% off retail prices and will purchase these goods at about a third of what they could sell it for. The experience and product offering are designed to be a step above a thrift store and target a middle-class consumer.

A Simple but Beautiful Business Model:

Franchise models can be attractive due to high margins, low capital intensity, and the ability to generate cash flow. Winmark is an especially attractive franchise model because the underlying business of resale goods is a resilient “all weather” type business that can withstand changes in economic growth and inflation. When you combine the franchise model with a portfolio of leading resale businesses operating under the proven Winmark playbook you are left with a business that is not necessarily sexy or high growth, but one that you can have a high degree of confidence will continue to grow cash flows over a long time horizon (the holy grail of investing in our eyes).

The power of this franchise model is reflected in the financials with gross margins of 95% and free cash flow margins around 50%. The business has practically no capex and the major expense on the income statement is SG&A at about 25% of revenue (which continues to decrease as a percentage of revenue as revenue grows). Management is aware that the biggest cost to the business are corporate costs and runs a wafer-thin operation of 83 total employees in a very cost efficient manner. This enables almost every dollar increase in royalty revenue to flow directly to shareholders in the form of dividends and share buybacks (management has bought back ~30% of shares since 2010).

The business model is flexible which allows for royalty growth to remain stable even during different cycles.

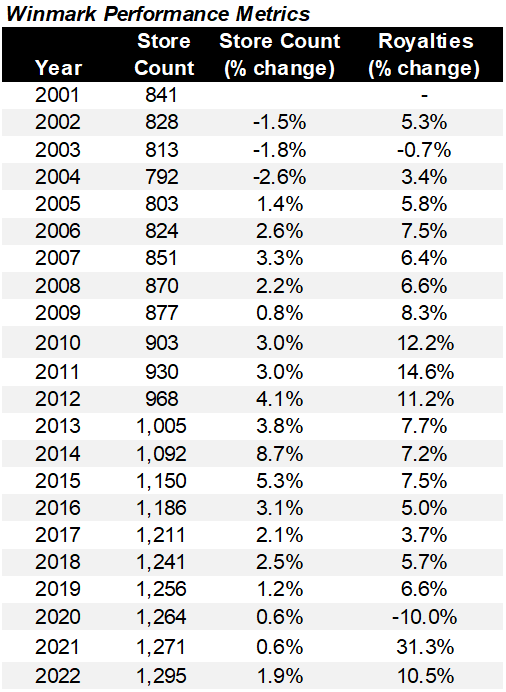

Royalty growth was 6.6% in 2008 and 8.3% in 2009 as there is a trade down effect during recessions – motivating consumers to purchase goods at a discount and sell old clothes and sports equipment to generate some extra cash. The other interesting observation from that time period is momentum continued for a few years after 2009 as it appeared that the Winmark concepts not only retained but also grew demand based on royalty growth rates.

During 2022 royalties increased $6.4 million or 10.5% compared to 2021 as stores offered a terrific value proposition when consumer wallets got tighter from increased inflation. Winmark does not face the same inflationary challenges as other retailers because stores are essentially operating at a fixed spread between new and used product prices.

Growth Drivers:

Royalty growth has only been negative two times (as can be seen in the table below). Once in 2003 when former CEO John Morgan was revamping the business which required cutting store count, and then in 2020 during the global pandemic. The average royalty growth since 2001 has been around 7.4% and we anticipate future long term growth to be at a similar cadence. We feel confident in this because there is still a ton of white space for Winmark to grow store count with the available territories webpage on Winmark’s website referencing 2,000 open locations (compared to current store count of 1,300).

In the short term we do anticipate an above-average uptick in royalty growth driven by an increase in store count. Between 2020 and 2022 new store growth was stagnant at 31 new stores, a slowdown that was mostly driven by pandemic induced uncertainty. This lull does appear to be coming to an end. According to the Q1 2023 earnings release there are now 70 stores awarded but not open. Stores at this stage typically take 12-15 months to open. This should translate to a 4% - 5% increase in store count in 2023, and hopefully similar results in 2024 if momentum continues. Winmark concepts do tend to attract new franchisees after proving to be stable during difficult times. The resilience and quality of the Winmark franchises over the past three years (a pandemic and then rapid inflation) is certainly a strong selling point to potential franchisees.

We do not want to put too much emphasis on this last growth driver but Winmark does find itself on the right side of ESG. Apparently sustainable fashion is all the rage, something Winmark has been a leader in far before it was trendy. Sustainable fashion encourages the recycling of materials and outfits as well as the reduction of emissions and questionable labor practices that go into producing clothing. These types of issues seem to especially resonate with Winmark’s primary demographic of women in their teens and twenties. There is admittedly a stigma with purchasing used products, but if the decision to buy used can be framed in a more eco-conscious light it may drive further demand over time.

The Value of Running a Winmark Franchise:

Winmark is selective in the franchisee selection process and prefers more of a quality over quantity approach. This may limit store growth, but it helps franchisees be more successful, drives higher sales per store, and helps keep franchise renewals high. Candidates must qualify both financially and operationally. The two primary financial criteria, for a Plato’s Closet for example, are a net worth of at least $400,000 and liquid assets of at least $75,000 to $100,000. Owners must also be operators with a preference for people that have direct experience in retail and are active in the community. Winmark also wants people that will follow Winmark’s proven model which has been refined over 30 years of experience.

As part of the franchise agreement the franchisee pays Winmark a certain percentage of sales as well as other expenses, outlined below.

Initial Franchise Fee: $15,000 to $25,000

Royalty: 4% to 5% of Sales

Marketing Fee: $1,500 per year

Renewal Fee: $10,000

The franchise agreement has an initial term of ten years, with subsequent ten year renewal periods. The franchise agreement grants a franchisee an exclusive geographic area, which will vary in size depending upon population, demographics, and other factors. The contracts also have a two-year non-compete.

Clearly there is some value to running a Winmark concept as shown by the 99% franchise renewal rate across all five brands since 2002. The stores generate more business than one may anticipate - according to Winmark the average Plato’s Closet had sales of $1,227,230 and an average gross profit of $777,664 in 2021. Besides the standard benefits provided to most franchises (marketing, training, etc.), Winmark also provides franchise owners with Winmark’s proprietary software which assist in all aspects of running a successful re-sales store from buy/sell price, inventory/sales management, a robust reporting system, and 24/7 support. Very few franchise owners have left the Winmark umbrella which proves the 4-5% royalty is a reasonable price commensurate with the value added by partnering with Winmark.

We spoke with some Winmark employees and franchisees, and the overall impression was positive and mostly confirmed what is communicated by management and the company - some of the takeaways included:

The proprietary software was touted as a big value add and something that was easy to use and easy to train people on.

Brand recognition was also another major advantage that franchisees saw from running a Winmark concept.

The strength of the concepts during economic downturns was mentioned as was the ability to be successful if one simply sticks to the Winmark model.

A response that resonated with us during one of these discussions is when we asked a franchisee if they would recommend running a concept to a family member or friend, their response was something along the lines of:

“No, because I would want to buy another franchise for myself”.

Competition & Threats:

Winmark’s three largest brands are the leaders in their respective resell markets. The main competition is from ma and pa boutique thrift/consignment concepts, but this market is so fragmented that there are no real immediate threats. We do not see the threat of online resale competitors to be significant because we believe there will always be a market/appeal to viewing previously owned merchandise in person to check for quality, cleanliness, and fit. Also the “treasure hunt” aspect of the experience does not translate well to online because browsing large inventories online can be cumbersome. The last note is that purely online resale models have disadvantages such as extra costs (shipping and cataloging inventory) and lack of trust from transacting with unknown sellers (in the case of consumer-to-consumer models).

Management Plucked from the Outsiders:

The management team at Winmark is reminiscent of the CEO’s described in William Thorndike’s “The Outsiders”. For those that are unfamiliar with “The Outsiders” it is a fantastic book that profiles “unconventional” CEOs that had tremendous success by not playing by the typical rules of Wall Street. This mentality seems to have been instilled in the company by former CEO John Morgan and is still very much how current management operates. This has proven to be very profitable for long-term shareholders with annualized returns north of 18% over a 5, 10, and 20 year time horizon.

Calling management un-promotional could be an understatement. Winmark has zero sell-side analyst coverage, does not have an IR department, and quarterly earnings are a minimalist production with no earnings calls, no presentation, and a short (4-5 page) earnings update. The only commentary from CEO Brett Heffes on the last earnings calls was:

“2023 is off to a good start”. - Brett Heffes, Winmark Q1 2023 Earnings Release

Some investors may be turned off by what could be perceived as a lack of transparency - we admire it. Management does not want to spend money or time to promote the stock, and why should they? Promoting the stock won't help increase franchises or royalty revenue and would just result in less cash flow to the shareholders and less time management can spend on operations. This focus on costs permeates across the organization. Management returns nearly all cash flow to shareholders in the form of a small but growing dividend (~1% as of today) and share repurchases, so the more they save the more shareholders earn.

Brett Heffes (CEO): Joined Winmark in 2002 and has served in a number of various roles at the company. Was named CEO in 2016 and was made chairman of the board in 2020. For more reading a recent interview with Brett can be found here and just about the only audio recording we could track down of him is here.

Tony Ishaug (CFO): Has served as CFO since September 2008, Treasurer since November 2009 and Executive Vice President since December 2016 (why hire three different people when one can do all three jobs?).

We believe management compensation is at or below market and note that Winmark does not pay an outside compensation consultant because:

“using compensation consultants would result in an increase in the level of compensation paid to our NEOs and ultimately be more expensive” - Winmark 2022 Proxy Statement

The management team has significant ownership in Winmark – not due to a requirement but by their individual choice. As of March 2023, Brett Heffes owned ~4% of share outstanding (49 times his base salary) and Tony Ishaug owned ~3% of share outstanding (32 times his base salary). We believe their incentives are aligned with shareholders.

Valuation:

Valuation is slightly elevated due to a ~40% run up in share price this year. You are currently getting a free cash flow yield of a little over 3% (not super exciting) but this yield will continue to increase year in and year out. Valuing this company using a DCF is fairly straightforward and based on our forecast yielded a price of ~$440. The terminal value usually contains a majority of the value in a DCF, and this is especially the case for Winmark with our assumptions being: a long term growth rate of 3.5% and a low, but we believe justifiable, WACC of ~7%.

As a side note, we are debating if we want to put price targets on every company we write-up because we are trying to identify companies to hold over the long term (and not sell immediately once it hits a price target). We view price targets as what we would pay as of today with what is currently knowable and using conservative forecasts. Price targets are dynamic in our eyes, not static.

Risks & Concerns:

Multiple contraction. Current multiples are elevated and will likely come down. This could be in the form of a price decrease, or company performance catching up to the valuation. Winmark has the characteristics of a long-term compounder, but overpaying could dampen performance in the near term.

Lack of transparency. There are no investor calls, no quarterly presentations, press releases are a few pages, and the 10k is only 50 pages. This may make it difficult to interpret or quickly understand changes in the business during inflection points or adverse price movements. We are able to get comfortable with this level of transparency because 1) management has shown to be very open to talking to investors and 2) this is a business model that we view as unique and considerably less volatile than most.

Run-off of Equipment Leasing business. Winmark began running off a legacy middle-market leasing business in 2021 that was set up by the prior CEO. Most of this business will likely run-off in the next three to five years. As of Q1 2023 this business only contributed around 7% to total gross income but it will be a slight drag on future royalty growth from the franchise business.

Closing Thoughts:

We believe Winmark is a truly unique business, a perpetual cash generator, and is well positioned for any market environment. Valuation is the biggest hurdle in our eyes, but we believe at the very least Winmark still warrants some preemptive research to determine if it is worthy of making the “shortlist” (so it can be acted upon in the case of a price decrease). We will note that even though business operations did not miss a beat during the ‘08 recession, the stock price did decline. We have no stakes in the fire in regards to the near term economic outlook, but a slowdown could present a fantastic buying opportunity. At the end of the day however we believe investors with a 10+ year time horizon will not be overly concerned about what initial multiple they paid.

Disclaimer

This publication should not be construed as investment advice. All assertions are solely the opinion of the author. The author may hold positions in the securities discussed or advise others that hold positions in the securities discussed. This publication is worked on during free-time, which reduces the amount of time and depth that can be spent on research and due diligence. Do your own research.

Great read. Love the company facts graphic! There was a Plato's Closet in my hometown and everyone knew the franchise owner to be well-liked and very successful. Can you speak to the -62.9% ROE TTM? Is this a function of macro market dynamics?

Definitely a very interesting company to look into. I am not sure what is more enticing buying the stock or becoming a franchisee. Insider ownership and management tenure is impressive clearly showing management is committed to building long term shareholder value.

A couple of questions. What has demonstrated that management is "very open to talking to investors"? Also, for WACC is this justified based on historical cost of capital, as it seems that given the minimal amount of debt should be significantly higher in the current environment?