Introduction:

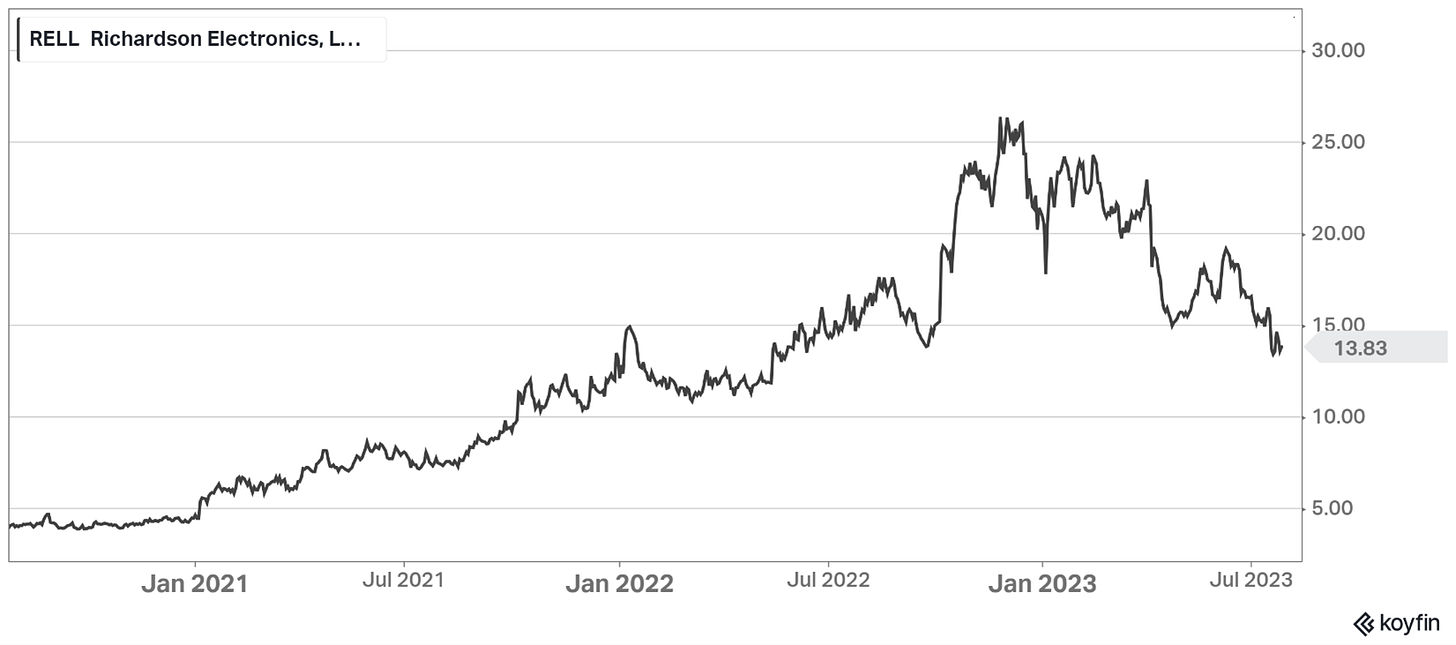

The subject of this post is a timely opportunity in a rapidly growing but misunderstood U.S. based macro cap, Richardson Electronics (“Richardson”). Richardson garnered investor attention in 2021 with the rapid growth in the company’s newly minted GES segment. However, a number of transitory headwinds have led to investors recently abandoning the name with the share price falling ~50% from recent highs as a result. Investors appear too focused on the short term results with this name, as these headwinds should begin to dissipate and turn into tailwinds in 2024.

I admittedly took a little longer than desired to get this third post out, there were a handful of interesting ideas that warranted a deep dive but I could not quite get there with 100% conviction yet (most notably BKE and RCMT). I do not want to sacrifice the quality/conviction of ideas just for the sake of being active. I am already working on the next post, which will be a slightly different format, and I am really excited about sharing it with everyone. Now that the housekeeping is out of the way let's dig into what makes Richardson a fond investment.

Business Background and Overview:

This section will be a little shorter as there are a handful of thorough write-ups online that detail Richardson’s history and segments (linked at the end for those interested). Richardson Electronics is an electrical components manufacturer. The business was founded in 1947 by Arthur Richardson as a power grid tube distributor and has grown to serve more than 20,000 customers worldwide. The current CEO is Arthur Richardson’s son, Edward (Ed) Richardson, who took over leadership of the Company in 1974 and led the Company through a public listing in 1983. Richardson operates in small niche end-markets and specializes in what the company dubbed “engineered solutions”, which consists of developing specialized products/components that address very specific needs or issues for customers.

Richardson’s business is comprised of four segments, highlights of each below:

PMT: Power & Microwave Technology (“PMT”) is Richardson’s largest segment and the modern iteration of the legacy tubes business. PMT has customers across multiple industries but the two largest end markets are semiconductors and communications. Richardson’s largest customer across all segments is Lam Research (LRCX), which uses Richardson products for the production of semiconductor wafer fabrication equipment. Semiconductors are a cyclical market, which can lead to more volatility in Richardson’s earnings, but I view this as an end market with long term secular growth drivers.

GES: Green Energy Solutions (“GES”) was part of PMT until being separated in FY 2023. This is the highest growth segment of the business and has the potential to grow into Richardson’s largest and most profitable segment. Momentum in GES took off with the development of the ULTRA3000, which is an ultracapacitor specifically engineered to be a superior alternative to lead acid batteries in GE wind turbines (the battery in a turbine is used to adjust the pitch of the rotors to ensure the maximum amount of energy is generated from wind). There is still material upside offered by ultracapacitors as Richardson grows the same technology for non-GE turbines, as well as other adjacent applications (such as telecom and back-up generators).

In addition to ultracapacitors GES is exposed to other high growth business opportunities such as selling magnetron tubes to Asian markets for synthetic diamond manufacturing and developing components for electric locomotives. The electric locomotive business is worth highlighting as it appears to be in the early innings of a meaningful growth opportunity, having recently completed the production and shipment of components in beta testing (which is the prerequisite for full scale production).

Canvys: The Canvys segment provides custom designed smart displays primarily used in healthcare equipment. This segment is relatively small but has been a nice business for Richardson with consistent growth and positive earnings contribution.

Healthcare: Healthcare is the smallest segment within Richardson and focuses on developing and marketing CT and MRI replacement tubes, notably for Cannon and Siemens products. This segment has been a bit of a bugaboo for the company and investors since the segment’s formation in 2011, as it has been a detractor to earnings despite management optimism over the years of it breaking even.

Why does this Opportunity Exist?

Richardson has faced a string of rough quarterly earnings and the expectation is that the next two or three will be lackluster. Richardson’s FY 2023 (which ends in May) was a great year and a major step forward for the company. However, in the second half of the year management signaled a potential slowdown from the semiconductor exposed business lines in PMT. This slowdown materialized in FY 2023 Q4 results, which was announced two weeks ago on July 19th. PMT sales, which was up ~20% each quarter for the year, suddenly dropped -20% Yoy in Q4. The cyclical downturn had been anticipated for multiple quarters, and the GES segment helped offset some of the losses, but the magnitude and speed of the drop-off in PMT appeared to surprise the market.

The near-term outlook is also poor. Earnings for the first half of Richardson’s FY 2024 (the remainder of calendar year 2023) will likely continue to be depressed and will face tough comps from the year prior. On the Q4 earnings call management noted that the expectation in FY 2024 is a further -$20 million revenue decline in the semi wafer capex business line. Unfortunately, it would be too optimistic to hope that growth in the GES segment can offset PMT declines. Management seemed to indicate that growth in GES would be more weighted towards the end of the year due to the project based nature of the segment. How does this all impact Richardson from an earnings perspective? I think a conservative EPS forecast for FY 2024 is close to $0.80, a near 50% decrease from FY 2023 EPS of $1.55.

The Turning Point:

Despite this near term uncertainty I still believe the long-term opportunity for Richardson is attractive. The second half of CY 2023 will be a challenge for Richardson but most factors weighing on the stock seem self-correcting. The cyclical semiconductor downturn will be transitory and GES has the potential to continue to rapidly grow and become the largest segment for the company (helping smooth out cyclical results from PMT in the future). If I was forced to estimate when the turning point would occur I would say Q2 of CY 2024 (in terms of business operations, not stock price). There are three primary catalysts that make me think this.

Recovery in Semi-wafer Customer Demand (first half of CY 2024). Richardson is being told by semi-wafer customers that the expectation is a recovery in the first half of CY 2024, with the second half seeing a potential boom. This sentiment appears consistent with what the large cap semi wafer fab companies have stated in their earnings. The downturn and subsequent recovery appears to be a “V” shaped one, with a quick and rapid return of demand driven by attrative end markets such as automobiles and AI.

Ed Richardson speaking to the recovery in demand anticipated by largest customer Lam Research during the Q4 2023 call:

“…they've come out with a much more optimistic forecast saying that by the end of 2024 that their business will even be stronger than where it's been in the past. And they've even gone so far to tell their vendors we'll help support you financially to make sure you have the resources to supply our products when we need them.”

Ed Richardson’s response on the Q4 2023 earnings call when asked about why management sees such a steep decline in sales from the semi wafer capex business:

“Well, we based that on the first two quarters. And you're right, we've heard that they think the trough is in the next quarter or two. And if that happens then it'll turn up much faster. But we'd rather underpromise and overperform…”

Excerpts from recent earnings of large cap semi wafer companies and their demand expectations:

“We continue to see second half 2023 WFE tracking higher than first half.” - Lam Research Corporation Q4 FY 2023 Earnings Call

“Given our current view of a stabilizing demand environment for the remainder of 2023, we expect full year calendar gross margin to trend near 61%.” - KLA Corporation Q4 FY 2023 Earnings Call

Inflection in GES Growth (Q2 of CY 2024). The GES segment will have growth across the various end markets (ultracapacitor, synthetic diamonds, and EV locomotive). However the most meaningful growth opportunity is presented by the EV Locomotives work with customer Progress Rail (a subsidiary of Caterpillar Inc.). Richardson shipped the final order of prototype products to Progress Rail in Q4. Progress Rail is expected to ship finished prototype EV trains to their end customers at the end of 2023. This means new production orders for locomotive batteries can be expected as soon as Q4 FY 2024 (Q2 of calendar year 2024). Just to give a sense of scale of the near term growth potential offered by this opportunity, it was noted during the FY Q3 2023 earnings call that Progress Rail had given Richardson “additional quotes for $91 million worth of products going into their locomotives in the future”.

Greg Peloquin speaking to the timing of new EV locomotive orders to Progress Rail during the Q4 2023 call:

“And so we had huge shipments in FY Q4 to meet our customers’ requirements so they could build their full electric locomotive. So I don't think we'll see production orders, as I mentioned, till FY Q3, Q4 of next year, large production orders.”

Profitability in the Healthcare Segment (Q2 of CY 2024). The healthcare segment is on track to break-even by the end of 2023, and has the potential to add to earnings by the first half of 2024. This is a meaningful catalyst as healthcare has been a roughly $5 million drag on the bottom-line of a ~$20 million earnings company. Management has a history of over-promising healthcare break-even expectations in the past, but the progress being made with the Siemens repair tube program is more than encouraging.

Wendy Diddell discussing the progress being made in the Healthcare segment during the Q4 2023 call:

“We know demand is strong based on discussions we've had with our customers. As noted in prior calls, the Siemens program is a critical element for our Healthcare business unit to reach its goal of providing a positive operating contribution to the company by Q4 of FY24.”

So why talk about Richardson now if I don't expect things to get better until Q2 2024? The share price is already depressed (read attractive), there could be a quicker than anticipated recovery in the semiconductor market, GES could make some large unexpected announcement, and I would expect forward looking investors to take notice before all the catalysts materialize. All this to say I like the longer-term prospects for Richardson and it feels like there is more to lose than to gain by trying to time a short term entry over the next few quarters.

Valuation:

Richardson is too cheap. Shares trade at 17x earnings when looking at the depressed FY 2024 EPS estimate of $0.80. FY 2025 should at the very least be able to recover to $1.40 in EPS (10x P/E) and if growth in GES meets expectations FY 2025 EPS could be north of $2.00 (which would be 7x P/E at that point). Richardson has a net cash debt position, double digit growth potential, and will be more cash generative once GES exits early growth mode and matures. The current valuation seems to reflect the next few quarters and not the longer term potential of Richardson.

Quick Note on Ownership:

This post is not a deep dive on Richardson, but one of the pertinent risk factors that must be mentioned even in a shorter form post is the ownership overhang. Notably, the 65% voting rights held by 80-year-old CEO and Chairman of the Board Ed Richardson via class B shares. This is something any potential investor must consider and get comfortable with. My take is that no one wants to see the business succeed more than Ed, and that Richardson's recent success has been in large part due to the next generation of leaders that head their respective segments (so succession planning is not a huge concern). The toughest pill to swallow here is the future ownership of Ed's class B shares, which are not subject to a sunset policy. One must weigh the opportunity/value offered currently against this risk. Hopefully this will not be a concern anytime soon - Ed still appears sharp as a tack in his 80s (I hope to be half as lucid at his age), and the man has already got me beat for the better hairline.

Conclusion:

There will likely be significant volatility in the share price of Richardson in the short term, notably on/around the next two earnings reports. If one can't stomach short term volatility this is likely a name best avoided. Longer-term Richardson has the potential to not just recover from the recent lull, but to grow into a much larger business supported by growth in the GES segment. Richardson is the embodiment of a fond investment: an opportunity not fully appreciated by others but with some patience it has the potential to outperform.

Additional Reading:

http://thepatientinvestors.blogspot.com/2022/07/richardson-is-having-interesting.html

Disclaimer

This publication should not be construed as investment advice. All assertions are solely the opinion of the author. The author may hold positions in the securities discussed or advise others that hold positions in the securities discussed. This publication is worked on during free-time, which reduces the amount of time and depth that can be spent on research and due diligence. Do your own research.

Interesting write-up. Have you considered their moat in all of the segments it operates in? The most important thing I want to know when investing in this kind of company, is whether their products are easily replicated or not.

A few things that may be of importance:

1. The company has not generated any significant cash in recent years even though revenue and profits increased.

Working capital has been sucking every last dollar and in recent conf calls taking on debt was contemplated. This may be a higher cap intensity co than you think.

2. It has dual share struct that pose risk to non controlling shareholders

3. Management quality is low and the company has been disappointing for years. The GES segment looks more like luck than skill and its advantage for the longer term is unclear.

I would still agree with the conclusion that it is a buy currently but there are probably better long term buys here.