Overview

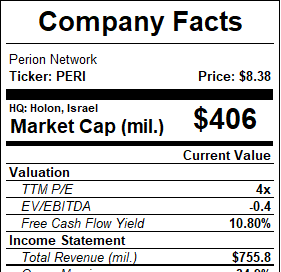

Perion Network (NASDAQ: PERI) is an Israeli based ad-tech business down -70% YTD. Shares traded down this year after Perion lost the majority of revenue from its largest customer, Microsoft Bing. This loss essentially shuttered one of Perion’s two core business segments overnight, but the remaining segment is the higher quality of the two, and has always been the long-term future of the business. Perion is currently trading at 0.8x 2025 sales and is a net-net with ~115% of its market cap in net cash. Shares are priced as if it is no longer a going concern despite the fact this is still a profitable business with attractive long term growth prospects.

You don't see many US listed companies trading at less than their net cash value these days, and when you do it is typically for a good reason (usually an assortment of low quality commodity businesses, early stage biotech, and some sketchy Chinese companies listed on a US exchange). I believe the market's poor understanding of the business, coupled with the now extreme negative sentiment, has created a unique opportunity to buy an average quality business at an unreasonably discounted price.

Update of Recent Events

Shares of Perion began the year at $30/share but are now hovering around $9 (~10% higher than the 52 week low set in June). The downward spiral began with a 20% drop in February after a “disappointing” FY24 guide that projected revenue in the range of $860M-$880M (17% YoY growth) and EBITDA of $178M-$182M.

Shares dropped a further -40% in the beginning of April when guidance was adjusted downwards due to significant pricing changes in Microsoft Bing’s Distribution marketplace, Bing being Perion’s largest customer at the time. The new guide reflected a material impact to Perion’s Search segment with total company revenue being revised down to $590M-$610M (-33% below the prior guide) and EBITDA of $78-$82M (-55% below the prior guide). This marked the biggest intraday drop in shares for Perion since 2008.

The final nail in the coffin came in the beginning of June when the price fell another -30% after another downward revision to FY24 guide, revenue now being forecasted at $490M to $510M (-17% below April guide) and EBITDA of $48M to $52M (-38% below April guide). This update made clear that the relationship with Bing was now an insignificant revenue driver with management stating “the agreement with Microsoft Bing is no longer material to Perion”, resulting in Bing going from 35% of total revenues in 2023, to less than 5% in 2H24.

Why This Unique Opportunity Exists

Shares of Perion should clearly be down after losing a majority of their business from their largest customer Bing, but the drop in value is not commensurate with the remaining value of Perion and its assets, with shares now essentially priced as if the company will fail. I believe the extreme valuation disconnect is being driven by a poor understanding of the business stemming from 1) an uninformed shareholder base and 2) poor management communication.

The Perion shareholder base has a large retail ownership of 40% and another 20% of the ownership is Israeli insurance companies, which is not very active capital. This results in a majority of the volume being driven by retail trading. Many of these shareholders were likely first introduced to the company at some point during a 10x run up in the price from a Covid low in 2020 of $4 to ATH in 2023 of $40. This sort of price action, and high retail ownership, can potentially lead to less informed shareholders because purchase decisions may have been driven by price action rather than fundamentals. Only investors with extremely high levels of conviction would hold through all three of the major sell-offs this year, a level of conviction that much of this investor base had understandably not developed.

All the blame cannot not be placed on retail shareholders because management has admittedly done a poor job of communicating what the business does and the fact that the search business was not the long term future (more on this in next section). Management has also been over-promotional for my taste, and did not quell much of the “AI hype” when everyone thought people would actually start using Bing after the Chat-GPT integration in the beginning of 2023. This resulted in a large number of shareholders not truly understanding what they owned and rationalizing their losses/sell decisions by creating a narrative of blaming management and a poor business model.

Business Context and How I Interpret the Recent Developments

To understand why the market is wrong here it is important to understand some basics about the business and what transpired the last few years. Perion has two distinct businesses that are essentially siloed from one another, which for the sake of clarity I will dub the “low quality business” and the “higher quality business”. The low quality and higher quality business accounted for 46% and 54% of 2023 sales respectively.

The low quality business is their search segment, the biggest customer of which was Microsoft Bing. This is a low tech and low value add business that generates revenue per click and is associated with practices such as click bait ads and click farms. The sort of crappy ads you see at the bottom of a webpage that say “you won't believe what these celebrities look like now!”. Low quality. Despite being low quality in nature this was a profit center for Perion with revenue from this business doubling from $173 million in 2019 to $345 million in 2023 (total of $1.2 billion over those 5 years). This is a high margin business and the incremental cost for another dollar of revenue was very low. Management made hay while they could in this business, which helped grow the company’s cash pile from $63 million in 2019 to $481 million in 2023 (there was a $200 million equity raise in that span, as well as a few acquisitions, but the point being this segment opportunistically generated lots of cash).

The higher quality business is made up of multiple smaller segments (Retail Media, Connected TV, and Digital Out-of-Home advertising) that place high impact ads across in-home and out of home categories (think personalized ads across podcasts, sports commercial breaks, food/grocery store aps, digital billboards, etc). Much of this technology utilizes AI-driven advertising solutions to deliver timely and personalized advertising. A specific example would be an individual sitting on their couch during a cold and rainy day streaming a show on an ad tier streaming subscription and an ad pops up that says “hey, it's cold and rainy outside, order delivery now from our restaurant and grab a bowl of soup for $2 off”. Much higher quality stuff.

Customers in the higher quality segment are diversified and include companies such as AT&T, Delta, Mercedes Benz, ESPN, and Albertsons. This business line has grown rapidly from $88 million in 2019 to $400 million by 2023 and has been where the majority of capital has been invested the past few years. A higher more sustainable moat can be built in this business and there are attractive long term growth prospects in using data to maximize advertising dollar spend. This is the future of this industry and the long term direction of Perion’s business.

If you have been following Perion closely you would know that the low quality business was never the future of Perion or the broader industry, and its eventual demise was inevitable (the timing was the true unknown here). Management was aware the low quality business came with an expiration date and drained every drop of juice from it while they could. Hindsight being 20/20 it was clear the end was drawing nearer based on management’s focus on diversifying away from the business, a change in CEO’s to one more willing to hold the position longer term, and recent capital allocation decisions. Management has certainly not been negligent with their treatment of this business line the past few years but very opportunistic by using it to build up the cash pile and positioning the business for future success in life after Bing.

Perion’s Prospects Going Forward

Perion in this new iteration is an ad-tech business that has grown sales at a 15% CAGR the past 3 years, should grow top line at a very conservative estimate of high single digits, is expected to generate $40 million of EBITDA in 2024, ~$0.30 EPS on a normalized basis, and has a $480 million war chest of cash on the balance sheet to pursue attractive acquisitions and accretive share buybacks. The company is solely focused on the technology and advertising solutions that are the future of the industry. Perion operates in a very dynamic industry, and this is not a top tier player such as Trade Desk, but what remains of Perion is not a business burdened with debt or burning through cash, and it should not be in the category of a company in trouble.

Having some degree of confidence in how management will use the cash pile going forward is the other important factor. At a market cap of $417 million the company is priced such that management will incinerate the $484 million cash on the books. I believe this to be unfounded. Despite sub-par communication skills I do think management is at the very least capable. Management has had a decent track record in terms of acquisitions (strategic targets, earnings accretive, reasonable prices), and if anything the only gripe could be they have not been active enough. Management also recently announced they are beginning a $75 million share repurchase program, which at the current price should create value for shareholders. This is something they have been hesitant to do until now despite pressures from investors, showing prudence given where the price was trading at the time and the pending changes to the Bing relationship.

Lastly, going forward the single biggest risk factor Perion faced of customer concentration has now been derisked with Bing essentially out of the picture. This kept shares trading at a perpetual discount (rightfully so it turned out) and now management can be solely focused on the next chapter for the business. Interestingly enough Perion actually went through a similar ordeal with Google in 2014 but managed to evolve the business and eventually rebound. Perion is in a much better position now due to a higher quality remaining business and the enormous cash position. The company is well positioned to control its own destiny.

Valuation

The low to mid tier ad-tech comps (CTV, PUBM, RAMP, TBLA, APPS, etc) trade between 1x to 3x sales. Using a conservative 1x sales multiple on 2025 sales of $500 million would imply a price of around $10. This is not giving any credit for Perion’s massive cash balance.

Perion has a net cash balance of $473 million which is roughly $8.75/share after removing an estimated $60 million of employee earnouts (a tool they use to pay lower price and incentivize acquired business). If you want to be ultra conservative and only give Perion credit for half of the cash balance (maybe they screw up some acquisitions) then you land at a conservative price of $14/share, or roughly 65% above the current share price.

To be clear, I do not think this is the most attractive of businesses, but at the current price the market is giving up on the business which makes this idea an especially compelling risk/reward over the longer term.

Catalyst

Capital allocation in the form of share buybacks and accretive acquisitions.

Narrative shift after a few quarters of operations allowing for a new shareholder base and deep value crowd getting involved.

Activist or notable investor acquiring shares (such a cheap price, this would likely be viewed as positive from the market).

Potential renegotiation of contract with Bing for more favorable terms at year end renewal or partnering with another search provider (low probability but high optionality catalyst).

Disclaimer

This publication should not be construed as investment advice. All assertions are solely the opinion of the author. The author may hold positions in the securities discussed or advise others that hold positions in the securities discussed. This publication is worked on during free-time, which reduces the amount of time and depth that can be spent on research and due diligence. Do your own research.

The cash balance is so stupid, management should use like 80% off to buy stock lol.

You are not accounting for the multiple lawsuits pending from investors against the company, which could very well damage the cash on bs