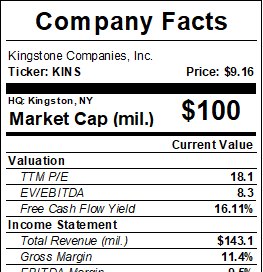

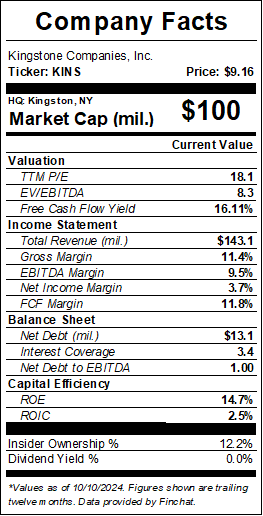

Kingstone Companies, Inc. (KINS) is a regional property and casualty insurance company that focuses on coastal properties in the Northeast, particularly downstate New York (NYC and Long Island). Kingstone is a high-quality insurer (industry leading combined ratio and ROE) trading at a heavily discounted valuation of just 5x my estimated 2025 earnings, largely due to recent struggles related to missteps in expansion and challenging market conditions.

However, Kingstone has executed a successful turnaround under new leadership and has refocused its strategy on its core markets. The company is now poised for significant near-term growth, with a major catalyst emerging as several competitors exit Kingstone's core New York market, leaving over $260 million in premiums up for grabs. With its improved underwriting and pricing strategies, Kingstone is in a prime position to capture a large portion of this business, setting the stage for strong earnings growth ahead.

What Does Kingstone Do?

Originally founded in 1886, the company focuses primarily on personal insurance, which makes up about 93% of its business. This includes homeowners, renters, and personal umbrella policies, especially for high-value coastal properties in places like the Hamptons. With coastal insurance being a tough niche to succeed in, larger insurers have retreated from these markets, giving Kingstone a major competitive advantage over the remaining competition due to its expertise and local presence in this market.

What Went Wrong?

The company’s recent challenges and poor stock performance stemmed from expanding too quickly outside of its core markets and underpricing policies. This move into non-core areas (namely New Jersey, Connecticut, Massachusetts, and Rhode Island), combined with rising inflation and expensive reinsurance, made things tough for Kingstone from 2020 to 2022. Claims costs spiked, especially as the North East saw more storm damage. As a result, the company’s market cap dropped dramatically—from $200 million in 2018 to just $10 million by the end of 2022.

The Turnaround

Recognizing the need for change, Kingstone launched a two-phase turnaround strategy. Under new management, they’ve taken several steps to rebuild the business:

Leadership Overhaul: Historically, Kingstone sourced much of its talent locally from Kingstone, NY, which limited its access to deep industry expertise. Recognizing this, the company brought in key senior leaders with significant experience in the broader insurance industry, helping to rebuild and modernize operations.

Improved Pricing: To counter rising loss trends and inflation, Kingstone adjusted its pricing strategy, ensuring that premiums accurately reflect the increased replacement costs of homes and other insured assets.

Product Revamp: In 2022, Kingstone introduced its new "Select" product line, which features more accurate pricing models designed with the help of an external actuarial firm. Since then, all new business has been written (more on the Select product later)

Expense Reduction: A key aspect of Kingstone's turnaround has been a strong focus on reducing expenses. Since 2021, the company has lowered its expense ratio from 41 to 31, outperforming the industry average of 33. This was achieved through staff reductions, renegotiated contracts, lower producer commissions, and technology-driven efficiencies. Kingstone aims to bring its expense ratio down further to 33 by the end of 2024.

Reinsurance Cost Management: Kingstone has fine-tuned its reinsurance strategy by incorporating reinsurance costs into its underwriting. This approach ensures that policy pricing better aligns with risk and the cost of reinsurance, leading to more effective cost management.

System Modernization: Kingstone upgraded its outdated internal systems, including a new claims management platform that was fully implemented in 2022.

As a result, Kingstone has seen big improvements. Their combined ratio—a key industry measure of underwriting profitability—fell to 78 in the most recent quarter. For context, a combined ratio below 100 means a company is making money on underwriting (the lower the better). Kingstone’s ratio is now among the best in the industry, with larger, more diversified peers averaging in the low 90s.

Quality Underwriters Getting Back on Track

Kingstone has been a quality underwriter in its core market. The main drag on performance has been its non-core markets, which the company is in the process of exiting. Non-core business currently represents 10% of the book, with direct written premium in this segment down 59.7% year-over-year.

The combined ratio referenced above is divided into two components: the net loss ratio (claims paid out) and the net expense ratio (costs of acquiring premiums). These sub-measures can be very informative because they help identify why an insurer is making (or losing) money. As shown below the net loss ratio for non-core business was well over 100 most quarters, while the core market averaged around 60 (even before Kingstone rolled out better pricing and their Select product). Underwriting performance should continue to improve as Kingstone continues to exit their non-core market.

Kingstone’s Select product boasts 10% fewer claims while taking better pricing, showcasing a more refined underwriting approach. This bodes extremely well for the future as Select represents less than 30% of their book as of Q1 and will grow rapidly in the quarters to come (all new policies are Select).

The recent improvement in Kingstone’s underwriting performance is not just a temporary uptick, but a direct result of the strategic changes implemented by the company. These adjustments have set a solid foundation for sustained profitability, positioning Kingstone to consistently operate with a combined ratio in the mid-80s throughout an insurance cycle.

Massive Market Opportunity Up for Grabs

In July 2023, three major competitors—Adirondack, AmGUARD, and Mountain Valley—exited the coastal New York property market, leaving over $260 million in premiums up for grabs. This presents a huge growth opportunity for Kingstone, which is now well-positioned to capture 20-30% of this market over the next year. The best part is that none of this is included in the current 2024 and 2025 guide from management. This market opportunity represents anywhere from an additional $0.20 to $0.50 in EPS by the end of 2025 (20% to 50% EPS boost from the low end of management’s 2024 EPS guide).

This opportunity comes at the perfect time. Kingstone is fresh off its successful turnaround and has streamlined operations, making it well-positioned to take advantage of the new business. In fact, in July 2024 alone, Kingstone saw a fivefold increase in new policies and a 13x jump in new business premium, signaling that this market opportunity is very real.

The main reason these competitors exited the market is similar to why Kingstone is exiting its non-core markets (and why the larger players already exited the market): a lack of any real edge leading to pricing that wasn’t adequate to cover the risk. For many insurers, it's easier to reduce exposure rather than continue competing in higher-risk areas like coastal New York. Kingstone has a distinct advantage in this market due to it being their core line of business, years of experience, and geographic proximity.

Valuation

Shares of Kingstone are undervalued at the current price of around $9 compared to what I believe to be a conservative price target of $17.50, implying nearly 100% upside. This valuation is based on the midpoint of management's 2025 EPS guidance ($1.40) plus my projected EPS boost from the recent market opportunity ($0.35), multiplied by a conservative 10x P/E ratio.

Other geographically concentrated coastal insurers (namely HRTG, UVE, and HCI) trade around 8x. Even at that multiple Kingstone is an attractive investment, but I believe Kingstone deserves a premium because the aforementioned peers are lower quality (higher CR’s and lower ROE’s) and they all operate primarily in FL, which is a very tough market due to rampant social inflation and increased cat risk. Kingstone historically has traded in the low teens while these peers were in the 8x-10x range, which I think helps further justify the premium.

Risks to Consider

The primary risk for Kingstone is a major storm hitting New York. Although the frequency and severity of such storms are lower than in Gulf Coast states, New York has still faced 37 hurricanes and tropical storms since 1970. Notable storms include Gloria (1985), Floyd (1999), Irene (2011), Sandy (2012), and Ida (2021), averaging one to two major events per decade. Management estimates that a Sandy-level event would result in a $4.75 million impact, translating to about a $0.40 hit to EPS. While this would have a significant short-term impact, investors would likely recoup losses over the long term.

Final Thoughts

Kingstone is a micro-cap insurance company with a solid turnaround story and a major growth opportunity right in front of it. With shares trading at a deep discount relative to its earnings potential, and the company poised to benefit from the exit of major competitors in its core markets, Kingstone offers significant upside potential in the next 12-24 months.

For those looking for a high-reward, under-the-radar stock in the insurance space, Kingstone Companies is worth serious consideration.

Disclaimer

This publication should not be construed as investment advice. All assertions are solely the opinion of the author. The author may hold positions in the securities discussed or advise others that hold positions in the securities discussed. This publication is worked on during free-time, which reduces the amount of time and depth that can be spent on research and due diligence. Do your own research.

I’ve been very bullish on insurance. Bought $KINS under $4. The turnaround is real!

"larger insurers have retreated from these markets, giving Kingstone a major competitive advantage over the remaining competition"

What is the logic here?